#1 in Credit Bureau Reporting

.png?width=115&height=117&name=Equal%20Housing%20Opportunity%20(2).png)

Trusted By Industry Leaders

A Win-Win for Landlords and Tenants

With Rent Reporting, Landlords see fewer missed payments and stronger accountability. Tenants are motivated to pay on time because it can help build credit, while missed payments appear on their credit.

Proven Benefits of Rent Reporting

Reward Responsibility, Reduce Risk

Rent Reporting gives Landlords a simple way to create accountability. Many have seen rent delinquencies drop by as much as 92 %, while Tenants report average credit score increases of 68 points. In fact, 70% of Renters say their credit improved after rent was reported.

Stop Late Rent Before It Starts

Rent Reporting helps ease the stress of missed rent. Each month, rent payment data is shared with the Credit Bureaus, helping Tenants build credit while giving Landlords a proven way to reduce delinquencies. Studies show 77% of Renters are more likely to pay on time when rent is reported.

.png?width=2000&height=1415&name=Recover%20Unpaid%20Rent%20(2).png)

Recover Unpaid Rent

Reporting unpaid rent through FrontLobby has proven to be 22x more effective than traditional collections. When a debt is reported, Tenants are notified and often reach out to make things right. Seeing the debt on their credit report creates accountability and usually leads to faster repayment.

Answers About Rent Reporting

What can I expect after I sign up? +

With a free account, you’ll be invited to a personalized onboarding session, get access to free Recordkeeping, and can purchase pay-per-use features as needed. You’ll also be able to explore the platform right away.

If you have questions, email us anytime at support@frontlobby.com.

How does Rent Reporting work? +

Each month, the platform collects rent payment information, including the amount paid and the payment date, and securely sends it to the Credit Bureaus. The Credit Bureaus then add this information to the Tenant’s credit profile.

Do I need Tenant consent to report rent? +

You do not need Tenant consent to report unpaid rent or rental debt. This is permitted under the Fair Credit Reporting Act (FCRA), which allows Landlords to report accurate debt information without Tenant approval.

However, Tenant consent is required to report on-time rent payments during an active tenancy.

How does Rent Reporting help Landlords? +

Our members report seeing fewer missed payments, stronger on-time habits, and better relationships with their Tenants. In some cases, Landlords have shared reductions in delinquencies of up to 92%.

Rent Reporting can also help attract responsible Tenants who value their credit and are more likely to pay on time when rent is reported to the Credit Bureaus each month.

How does Rent Reporting help Tenants? +

By regularly reporting rental payment data, Renters can establish a positive credit history. This can have significant benefits for Renters, such as improving their credit scores, increasing their chances of qualifying for future loans or rentals, and unlocking better interest rates.

Can I report past rent or unpaid debt? +

Yes. FrontLobby allows Landlords to report unpaid rent after a Tenant has moved out. Once reported, the debt appears on the Tenant’s credit report, creating accountability and encouraging repayment.

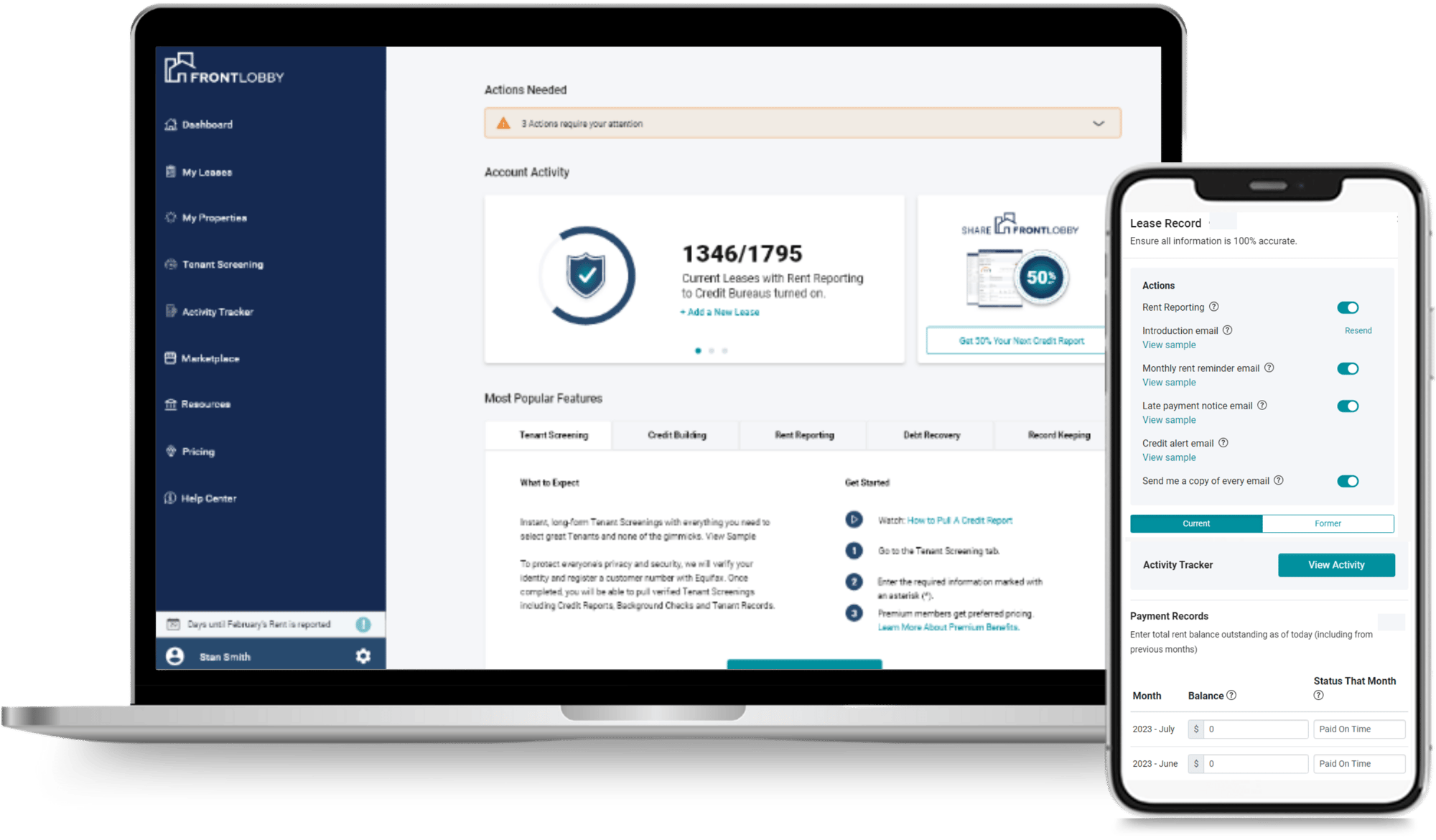

Start Reporting Rent in Minutes

Make Rent Count

FrontLobby makes it easy for any Landlord or Property Manager to report rent to the Credit Bureaus. No technology requirements, no large portfolios, and no experience needed. It’s quick to set up, simple to use, and already trusted by thousands of Housing Providers.

0K +

Housing Providers

0M +

Members Rental Units

0%

Delinquency Reduction

0pt

Average Credit Boost

-2.png?width=250&height=63&name=FrontLobby%20Primary%20Logo%20(White)-2.png)

.png?width=2000&height=1377&name=FrontLobby%20Partnership%20Landing%20Page%20(2).png)